LPT – What the changes mean?

On 1 June 2021, the Cabinet agreed to bring forward legislation that will propose changes to how Local Property Tax (LPT) currently operates. LPT is a self-assessed tax charged on the market value of residential properties in the State. There were some exemptions to the system including first time buyers who purchased in 2013 along with all new builds since 2013. LPT is payable by the owner of the property – regardless of whether you live in the property, or it is rented out.

However, since 2013 there has been a rise in the value of property and many people now face an increase in their LPT. The bands have been widened to ensure that most homeowners do not face higher bills. The national average house price in 2013 was €189,000, rising to €284,000 this year. Over the same time, average prices soared in Dublin from €249,500 to €360,000.

Your property will need to be revalued in November 2021, but this can be done by yourself by doing a search on the Property Price Register and also on the main property portals daft.ie and myhome.ie. Failing that we recommend contacting your local estate agent to get an indication of value. The changes to the bill mean that your property value will be reviewed every 2 years.

The LPT is payable to your local authority and local authorities have the ability to vary their rates so check out your local authority’s rates: Has your Local Authority Rate changed? (revenue.ie). Local authorities are entitled to reduce the rate by a maximum of 15%.

The new bands are set out below:

Houses vacated by their owners due to illness are currently not liable to LPT, on the condition the property remains vacant. In future, the condition of vacancy will not apply, meaning that the home could be rented out and the LPT would still not apply.

See The Journal.ie’s article for a more in-depth analysis: Explainer: What will the changes to the Local Property Tax mean for your yearly bill? (thejournal.ie)

Invest or Save? What €300,000 Can Really Do – Dublin 8 Property vs. Bank Deposit

Investors often face a key question:

“Should I leave my money in the bank—or use it to buy a property?”

Let’s compare two real-world options using today’s figures:

✅ Option 1: Invest in a 1-Bedroom Apartment in Dublin 8

This well-located apartment offers excellent potential with market rent of €2,100/month, and is not rent capped, allowing full income flexibility. A modest refurbishment and standard purchase costs apply.

💰 Investment Breakdown:

- Purchase Price: €300,000

- Stamp Duty (1%): €3,000

- Solicitor Fees (1%): €3,000

- Capital Upgrade (kitchen + bathroom): €12,000

- Total Upfront Cost: €318,000

📈 Rental Income & Costs:

- Annual Gross Rent: €2,100 x 12 = €25,200

- Annual Management Fees: €2,500

- Other Allowable Expenses: €2,500

- Total Deductible Costs: €5,000

- Taxable Rental Income: €25,200 – €5,000 = €20,200

- Income Tax @49%: €9,898

- Net Annual Rental Income: €25,200 – €9,898 = €15,302

📊 Yield:

- Net Yield (Post-Tax on €318,000): 4.81%

🏦 Option 2: Deposit €300,000 in a Pillar Bank

- Average Interest Rate: 2%

- Gross Annual Interest: €6,000

- DIRT Tax (33%): €2,000

- Net Annual Return: €4,000

- Net Yield: 1.33%

🔍 5-Year Comparison – Property vs. Savings

| Metric | Property Investment | Bank Deposit |

|---|---|---|

| Initial Outlay | €318,000 | €300,000 |

| Net Annual Income (after tax) | €15,302 | €4,000 |

| 5-Year Net Income | €76,510 | €20,000 |

| Rent Cap? | No | N/A |

| Capital Appreciation? | Yes (market dependent) | No |

Note: Assumes full occupancy and no mortgage. Capital growth potential not included.

🏁 Conclusion: Why This Dublin 8 Property Makes Sense

Even with taxes, fees, and capital works included, this property delivers a net income nearly 4x higher than a savings account over five years.

With:

- No rent restrictions

- Strong tenant demand

- A central Dublin location

- And future resale potential

…it represents a far more productive use of capital than leaving money idle in the bank.

📞 Interested?

Contact Hopkins Ward today for a tailored investment breakdown or to arrange a private viewing of this opportunity.

The Perfect Storm: Why a Cohort of Landlords Are Exiting Ireland’s Residential Market

In recent years, a growing number of landlords—particularly small to mid-sized investors—have been steadily exiting the Irish residential rental market. While this trend has sparked concern about dwindling rental supply and rising rents, the motivations behind these exits are often misunderstood or oversimplified.

The reality is more complex: a “perfect storm” of financial, regulatory, and structural pressures is pushing certain landlords to sell. Here are the core drivers behind this shift:

—

1. Strong Capital Values Create an Exit Opportunity

1. Strong Capital Values Create an Exit Opportunity

Property prices have appreciated significantly over the past decade, especially in urban centres. For landlords who bought in the post-2008 period, the potential to realise capital gains is now highly attractive.

In many cases, the prospect of a lump-sum return outweighs the shrinking margins and rising risks of holding and renting residential property. In effect, strong asset values have made the “sell” button look very appealing.

—

2. Over-Taxation and Marginal Returns

2. Over-Taxation and Marginal Returns

Landlords in Ireland often operate in a highly unfavourable tax environment, especially compared to other forms of investment.

Rental income is taxed at marginal rates, sometimes as high as 52%.

Deductions are limited.

PRSI and USC add further strain.

When combined with rising costs (e.g., insurance, maintenance, interest rates), many landlords find their net yields falling below acceptable levels, prompting them to exit while property values remain high.

—

3. Rent Pressure Zone (RPZ) Regulations

3. Rent Pressure Zone (RPZ) Regulations

RPZ rules—designed to protect tenants from steep rent hikes—have had unintended consequences.

For long-term landlords, rent caps often mean they’re locked into below-market rents, while their costs continue to rise. Meanwhile, newer landlords who bought at higher valuations can set rents closer to market rate, creating an uneven playing field.

The result? Legacy landlords often feel financially penalised for tenant stability.

—

4. A Perception of Regulatory Bias

4. A Perception of Regulatory Bias

There’s a growing sentiment among some landlords that the Residential Tenancies Board (RTB) is biased or overly protective of tenants.

While the RTB serves a critical role in maintaining fairness in the rental sector, certain landlords view the dispute resolution process as time-consuming and costly, with limited recourse for property owners in cases of arrears, damage, or anti-social behaviour.

This perception—fair or not—has created a sense of disempowerment and risk, further tipping the balance toward exit.

—

A Quiet, Accelerating Exodus

A Quiet, Accelerating Exodus

It’s important to emphasise that this isn’t a blanket trend across the sector. Many landlords remain committed, particularly institutional investors or those with professional scale. However, for “accidental” landlords or smaller investors, the equation has changed.

With returns compressed, risks heightened, and regulation increasingly complex, the incentive to stay in the market has eroded—especially when capital appreciation offers a cleaner, simpler path to exit.

—

Final Thought

Final Thought

Policymakers and stakeholders must grapple with the long-term implications of these exits. The private rental sector still houses a large share of the population, and supply constraints will only worsen if experienced landlords continue to leave.

Recognising this “perfect storm” isn’t about picking sides—it’s about understanding the full landscape so that solutions can be both tenant-protective and investment-sustaining.

Overview of RPZ reforms introduced by Minister James Browne on 10th June 2025.

1. Nationwide Extension of RPZs

The existing 2% annual rent cap (or inflation rate, whichever is lower) currently applied in high-demand zones will now be extended across all tenancies nationwide .

2. Inflation-based Increases for New Builds

Rents on apartments built after a future cut off date can rise in line with CPI inflation, not restricted to the 2% RPZ cap .

3. Rent Reset & Six‑Year Tenancy Terms

A minimum rolling six-year tenancy will be introduced for new tenancies starting March 1, 2026.

At the end of six years, rents may be reset to the market rate, with further increases then limited by CPI .

For existing tenancies, no reset will occur unless the tenant voluntarily leaves .

4. Ban on No‑Fault Evictions by Large Landlords

From March 1, 2026, landlords managing 4+ units will be banned from no-fault evictions.

Smaller landlords (fewer than 4 units) can still use no-fault evictions in limited cases—e.g., to move a family member—though they cannot reset rents if such an eviction occurs .

5. Stricter Enforcement & Higher Fines

Minister James Browne announced plans to increase fines for landlords who breach rules (e.g. abusing eviction bans), potentially handing more cases to courts over the Residential Tenancies Board .

A rents register is also being considered to improve transparency on rental history .

Is it time to end/ease RPZ regulations?

Ireland’s housing crisis is a deeply emotional and often polarizing issue, with rent pressure zones (RPZs) introduced in 2016 as a well-intentioned response to spiraling rents. These zones, which cap rent increases at a set percentage annually (currently 2%), were designed to protect tenants from sudden and unaffordable hikes. But nearly a decade later, it’s worth asking: has this approach outlived its effectiveness? Increasingly, the answer is yes — and it’s time to consider easing RPZ legislation for the benefit of both renters and the broader housing ecosystem.

The Supply Problem RPZs Can’t Fix

The root of Ireland’s housing crisis isn’t greedy landlords — it’s the chronic undersupply of homes. RPZs, while aiming to shield tenants, do not address the fundamental shortage of available rental properties. If anything, they may be exacerbating it. Many private landlords, particularly small-scale ones, have found the RPZ rules overly restrictive and financially unsustainable. The result? A mass exodus of landlords from the market.

This shrinking supply has left fewer homes for renters, tightening competition and pushing up rents on newly available properties. Ironically, in trying to make renting more affordable, RPZs may be contributing to the scarcity that drives prices up in the first place.

Encouraging Investment in the Rental Sector

To resolve Ireland’s housing crisis, we need more investment in rental accommodation, not less. Easing RPZ legislation would send a clear signal to private investors and developers: the rental market is viable and worth supporting.

Institutional investors, who are increasingly seen as villains in the housing debate, actually play a crucial role in scaling up supply — especially for new-build apartments. But overly rigid rent caps deter them from entering or expanding in Irish markets. A more balanced, flexible framework would attract the kind of investment needed to boost long-term supply and improve housing quality.

Flexibility Can Still Protect Tenants

Easing RPZ legislation doesn’t mean abandoning tenant protections. On the contrary, easing can be paired with smarter policies that still safeguard renters — such as longer lease terms, enhanced transparency around rent setting, and targeted supports for vulnerable tenants.

What’s needed is a more nuanced approach that acknowledges regional differences and market dynamics. One-size-fits-all caps may work in certain high-pressure urban areas but be unnecessary or even harmful in others. A more flexible system could allow for local discretion while preserving fair treatment for tenants.

Supporting a Sustainable Rental Market

A healthy rental market requires balance: between tenants’ need for stability and landlords’ need for fair returns. If we tip too far in one direction, we risk destabilizing the whole system. RPZs have provided short-term relief, but they are not a sustainable long-term solution.

By easing RPZ legislation — while continuing to support tenants in other meaningful ways — Ireland can foster a more dynamic, responsive, and ultimately more humane rental market. The goal should not be to freeze rents indefinitely, but to create a system where housing is accessible, investment is encouraged, and the market functions efficiently for everyone involved.

It’s time for a decisive, forward-looking conversation — one that acknowledges where RPZs have helped, but also where they are holding us back. Easing the legislation may just be the bold step Ireland needs to unlock lasting progress.

Why Private Landlords in Ireland Should Instruct an Estate Agent to Manage Their Property

In the increasingly regulated landscape of residential letting in Ireland, private landlords face a growing number of legal and practical challenges. Engaging a professional estate agent to manage a rental property is no longer just a matter of convenience—it can be a crucial step in protecting one’s investment and complying with stringent legal obligations.

Below, we explore the key benefits of professional property management, particularly in the context of Irish landlord and tenant law, Rent Pressure Zones (RPZs), tenancy structures, and tax obligations for non-resident landlords.

1. Compliance with the Law: Avoiding Costly Mistakes

Irish landlord-tenant law, governed primarily by the Residential Tenancies Act 2004 (as amended), imposes strict obligations on landlords. These include:

- Registering tenancies with the Residential Tenancies Board (RTB) within 1 month.

- Adhering to notice periods and valid grounds for termination.

- Providing minimum standards of accommodation.

- Observing rent-setting and review rules in RPZs.

Professional estate agents are well-versed in these requirements and can ensure full compliance, helping landlords avoid fines, disputes, or legal action. RTB compliance errors—especially around termination notices and rent reviews—are among the most common reasons landlords find themselves in legal difficulty.

2. Rent Pressure Zones (RPZs): Rent Control Expertise

Most urban areas in Ireland, including Dublin, Cork, and Galway, fall within RPZs, where annual rent increases are tightly regulated.

Key rules include:

- Rent increases are limited to 2% per annum, or linked to the Harmonised Index of Consumer Prices (HICP), whichever is lower.

- Rent cannot be increased more than once every 12 months.

- Rent reviews must include valid comparables and be served with 90 days’ notice.

Estate agents ensure all documentation is correct, calculate the permitted increase under the current rules, and help avoid invalid notices—one of the top triggers for RTB disputes.

3. Fixed-Term vs Part 4 Tenancies: Legal and Practical Implications

Understanding tenancy types is critical for managing leases and planning future use of the property:

Fixed-Term Tenancy

- A lease agreed for a specific duration (commonly 6 or 12 months).

- Early termination is generally not allowed unless both parties agree or a breach occurs.

Part 4 Tenancy

- After 6 months’ continuous occupation, tenants automatically gain Part 4 rights.

- This allows them to remain in the property for up to 6 years (or 12 years for tenancies starting after July 2022), regardless of the original lease term.

- Termination during a Part 4 tenancy requires specific legal grounds (e.g. sale, substantial renovation, landlord’s own use).

Estate agents can help manage lease transitions and ensure proper termination notices, including statutory declarations, where needed.

4. Non-Resident Landlords: Withholding Tax Obligations

Landlords who are not tax resident in Ireland must navigate specific tax obligations. Under Section 1041 of the Taxes Consolidation Act 1997, tenants or agents must withhold tax as follows:

Two Options for Compliance:

A. Letting Through an Agent

- The agent becomes the “collection agent” for Revenue.

- They are responsible for:

- Filing annual returns (Form 11 or Form 41).

- Withholding the appropriate tax and remitting it to Revenue.

- Issuing annual income statements to the landlord.

Letting agents are familiar with this process and ensure compliance, allowing the non-resident landlord to receive gross rent.

B. Letting Without an Agent

- The tenant must withhold 20% of the gross rent and remit it to Revenue.

- The tenant must register with Revenue and issue a Form R185 to the landlord.

This is often impractical for tenants and risks non-compliance. Engaging an agent removes the burden from tenants and ensures proper tax treatment under Irish law.

Key Benefit: Withholding tax issues can lead to complications in Revenue audits or when applying for tax clearance certificates. An estate agent acting as a collection agent eliminates these risks.

5. Professional Tenant Vetting and Risk Reduction

Agents use formal referencing procedures, checking employment, credit history, and landlord references. In a system where legal evictions can take months and incur costs, prevention is better than cure.

6. Efficient Rent Collection and Dispute Management

Estate agents ensure timely rent collection, issue reminders, and deal with late payments quickly. Should a dispute arise, they can represent landlords in RTB proceedings, often achieving better outcomes due to their experience with the process and documentation standards.

7. Maintenance, Inspections, and Legal Housing Standards

Irish law requires rental properties to meet specific Minimum Standards, including:

- Proper heating

- Fire safety systems

- Adequate ventilation and lighting

Agents coordinate inspections, handle emergency repairs, and ensure continued compliance, reducing the likelihood of RTB complaints or Local Authority enforcement.

8. Tax-Efficient Record Keeping and Annual Statements

Estate agents provide:

- Monthly and annual rental statements

- Documentation of expenses for Revenue reporting

- End-of-year summaries for accountants or tax advisors

This is particularly helpful for non-resident landlords dealing with international tax reporting and potential double taxation agreements.

9. Peace of Mind, Especially for Non-Resident and Accidental Landlords

For landlords living abroad, or those who have inherited or moved out of a primary residence, a professional letting agent offers reliable oversight, reducing legal and financial exposure.

They also provide advice on changes to law, such as RPZ reclassifications, eviction bans, or amendments to the Residential Tenancies Act.

Conclusion

In an era of rising regulation and tax complexity, especially for non-resident landlords, using a professional estate agent is not just a convenience—it’s a protective strategy. From RPZ rent caps to withholding tax compliance, estate agents ensure landlords meet their obligations while maximizing their return.

For Irish landlords at home or abroad, it’s clear: the right agent doesn’t just manage property—they manage risk, compliance, and peace of mind.

Navigating Legal Boundaries in Software Licensing Today

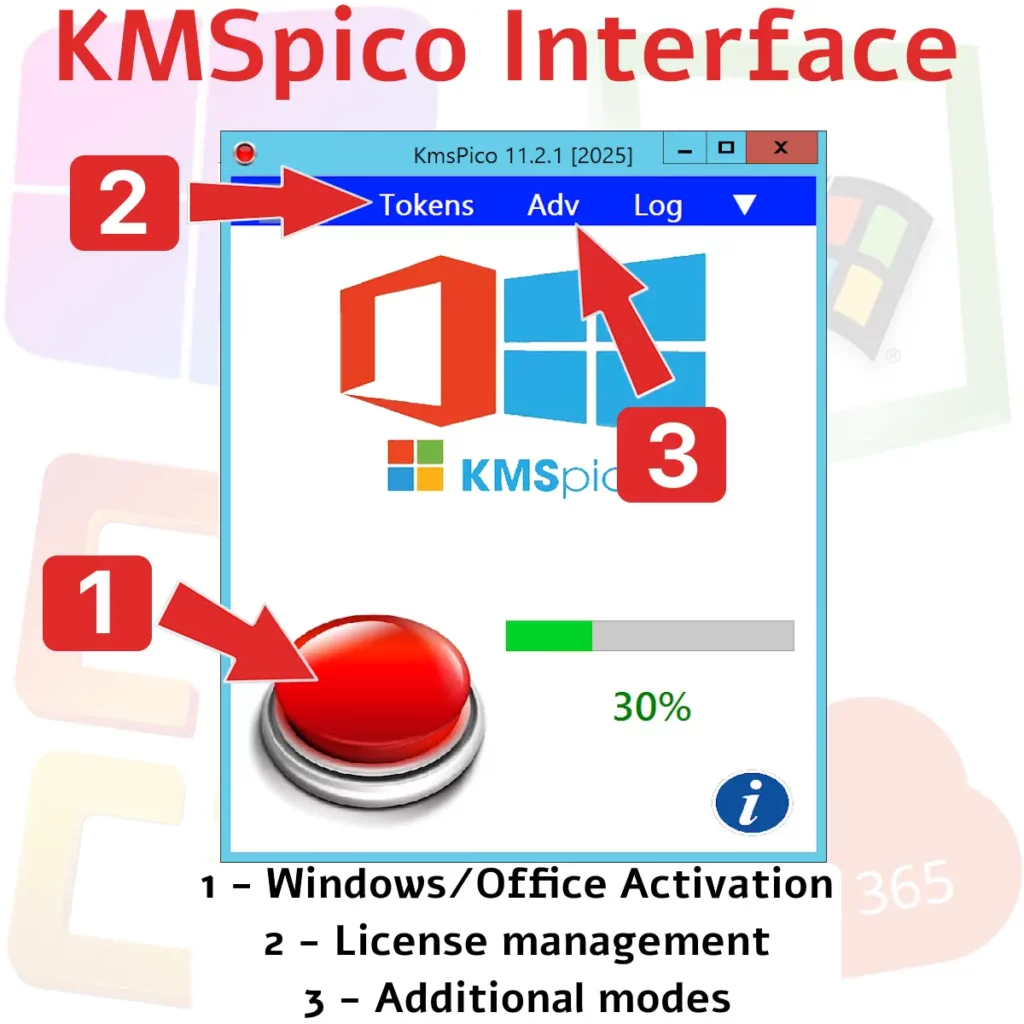

In the realm of software licensing, navigating the legal boundaries can often be a challenging task. This challenge is exemplified when considering tools like KMSPico, which many users turn to for unauthorized software activation. Specifically, the interest to download kmspico windows 10 raises significant questions about legality and ethical usage of software.

The Intricacies of Downloading KMSPico for Windows 10

For users looking to download kmspico windows 10, it’s crucial to understand what this tool represents. Designed as a Microsoft Office activator and Windows activator, KMSPico mimics legitimate licensing features by activating Windows without a genuine product key. While some see this as a cost-saving measure, it blatantly disregards Microsoft’s licensing agreements. The process might seem straightforward on the surface, but beneath lies a complex web of potential legal and ethical issues that every user must consider before proceeding.

Understanding the Legal Implications

When users choose to download kmspico windows 10, they may not fully grasp the legal ramifications involved. Using such software crack tools for free activation effectively constitutes a breach of terms set by Microsoft. The potential consequences include legal action and financial penalties. Moreover, engaging with unauthorized software can result in compromised system security, exposing users to malware and other cyber threats that could further complicate matters.

How Does KMSPico Function?

- KMS Activator: Utilizes Key Management Service (KMS) technology to trick the Windows operating system into believing it’s activated.

- No Genuine License: Provides no real license but temporarily bypasses activation protocols.

- Risks Involved: Comes with security risks due to its nature as unauthorized software.

KMSPico operates by exploiting vulnerabilities in Microsoft’s activation system. By mimicking legitimate activation processes, it gives an illusion of authenticity that is inherently risky. Users should be aware that using such tools might lead to unexpected behavior in their operating systems or even permanent damage if things go awry.

The Evolution from KMSPico 11 to KMSPico 11.2.1

The journey from KMSPico 11 to its later version, kmspico 11.2.1, illustrates an ongoing cat-and-mouse game with Microsoft’s security measures. Each update seeks to overcome new defenses implemented by Microsoft against unlicensed activation attempts. Such constant evolution underscores the persistent demand for free activation solutions despite the clear warnings from software developers regarding their use.

Key Features of KMSPico 11.2.1

This version attempts to refine previous functionalities and enhance reliability in activating newer versions such as Windows 10 and potentially looking towards future applications like kms activator windows 11. With each iteration, the developers behind these tools aim to provide more seamless experiences for users seeking unauthorized activations.

Technical Requirements for Installation

To effectively run KMSPico on a lab setup devoid of risks, certain constraints should be followed, such as utilizing a VM with at least 2 vCPU and 4 GB RAM. This provides a controlled environment that isolates potential malware associated with unauthorized software use. However, even with precautions like these, the risk of collateral damage remains high if precautions are not strictly adhered to.

Legal Alternatives to Downloading KMSPico for Windows 10

Rather than opting for unauthorized downloads like kmspico download, users have other legitimate options. Microsoft offers trial periods for most products, allowing users to explore features before committing financially. Additionally, educational discounts or volume licensing can make legitimate purchases more affordable. These alternatives not only ensure compliance but also offer peace of mind knowing that your system is secure from potentially harmful software.

The DISM Tool for Legitimate Activation

The Deployment Image Servicing and Management (DISM) tool is one example of a legitimate way to service Windows images and manage licenses. Unlike kmspico windows activator tools that hack activation processes, DISM uses proper authorization channels provided by Microsoft. This ensures that your system remains compliant with all necessary legal requirements while safeguarding against potential threats associated with illegal software use.

Ensuring Compliance in Software Licensing

- Regular Audits: Conduct routine checks on software licensing status across systems.

- User Education: Educate end-users about the risks associated with unauthorized software cracks and free activation tools.

- Policy Enforcement: Implement policies that limit administrative access to ensure only vetted software is installed.

Ensuring compliance goes beyond mere adherence; it’s about fostering an organizational culture that prioritizes legality and ethical responsibility in all technological engagements. By educating employees and enforcing strict policies on software usage, companies can significantly mitigate risks associated with unauthorized activations.

The Broader Context of Using Tools Like KMSPico

The inclination to download kmspico windows 10 reflects wider issues in digital content access and consumer expectations regarding free software availability. As technology advances towards iterations like kmspico 2025 or equivalent emerging tools, understanding these broader implications becomes essential for both consumers and enterprises alike. The demand for free solutions often stems from economic constraints; however, consumers need to weigh these against the potential costs incurred through legal troubles or compromised data integrity.

The future trajectory of digital tool usage will likely hinge upon balancing accessibility with legality—and ensuring widespread awareness about compliance will play a critical role in shaping this landscape.

Ethical Considerations in Downloading KMSPico Windows 10

As we delve deeper into why individuals opt to download kmspico windows 10 despite known risks, it’s vital to consider how education around digital rights management could shift perceptions toward more ethical practices in tech consumption. Understanding the full scope of implications—legal or otherwise—can guide better decision-making both at an individual level and within larger organizational structures dedicated to sustainable tech advancements.

Ultimately, while the allure of free activation through means such as downloading kms activator tools may seem tempting, it is imperative to weigh these decisions against the potential legal risks and ethical considerations involved in circumventing established software licensing frameworks. By choosing legitimate paths over shortcuts offered by unauthorized tools like KMSPico, users contribute positively towards an ecosystem where innovation thrives under fair conditions supported by proper compensation for creators’ efforts.

The decision whether or not to engage with such tools is not just about personal gain but also reflects on one’s stance towards respecting intellectual property rights—a fundamental pillar supporting sustained technological progress globally.

Why Live in Dublin 8?

A lot of new trendy coffee shops, pubs and eateries have opened up around the Dublin 8 area (one of our favourites is Noshington!) catering for the new wave of buyers migrating from Rathmines, Ranelagh, Harolds Cross and Terenure.

There are numerous colleges within this postcode making it a young demographic for city slickers. The neighborhood statistics show that 36% of households in Dublin 8 comprise of one person, 23% are house shares and 18% couples. The average age group is 16 – 35 years old*. *CSO Statistics

If you’re thinking of moving to the area there are some great amenities and attractions nearby. The most famous sites in Dublin 8 are the Guinness Brewery and Gravity Bar at St. James’s Gate, Christchurch Cathedral, Kilmainham Gaol, the Grand Canal, Royal Hospital Kilmainham and Vicar Street, which is host to many comedy acts and gigs.

We are currently in a very buoyant market with 4 out of every 5 homes coming on the market with us selling within 4 weeks. We believe we are set to enjoy a good market for the short to medium term and there is plenty of property for investors to choose from.

If you are in the market to sell or rent your property, please get in touch. We love this area as much as your next purchaser and tenant does and this makes all the difference.

info@hopkinsward.ie www.hopkinsward.ie

01 4967954

Is Dublin 8 ready for high rise?

The former Player Wills factory has long been a contentious site in Dublin 8. Built to designs by Beckett & Harrington for W.D. and H.O. Wills in 1935, this building remained in use as a tobacco factory until 2005. Its form, scale and design make it an imposing presence on South Circular Road, and its’ obviously industrial function creates a striking contrast to the predominantly domestic architecture of the street. In recent years, the site has been used as a set for TV shows.

Recently the property was purchased by US property group Hines along with the Bailey Gibson packaging site. Hines was last September granted permission by the board for 416 homes, which included a 16-storey apartment block, on the site of the former Bailey Gibson packaging plant, which adjoins the Player Wills site.

In recent days, the site and the developers have hit the headlines with a 19-storey building among its new plan submitted to An Bord Pleanala. The plans submitted include a scheme of 732 apartments, one third of which would be co-living units. This has caused consternation among the local Dublin 8 residents, who have an issue with overlooking and blocking light in the area. The area is predominantly low-rise with 2 storey red-brick dwellings lining the South Circular Road and surrounding roads.

This site sits directly opposite our office so we will be keeping a keen eye on any developments in this story. We’ll bring you all the latest when we have it.

While there is a need for high rise buildings within the city, it remains to be seen if this site will be among them. Further information can be found on the Irish Times story released on Thursday:

‘Horrendously out of proportion’: Residents set against 19-storey apartments (irishtimes.com)

Level 5 COVID-19 Restrictions January 2021

This new year brings an unwelcome, but necessary, return to the Level 5 restrictions by the government in order to reduce the number of COVID-19 cases that have risen post-Christmas. Thankfully, the Property Services Regulatory Authority this week confirmed that Property Services are still recognised as an essential service.

What does this mean?

Property Services must only be provided in accordance with the provisions as set out at Level 5 of the Property Services Providers Guidance to Implementing Plan for Living with Covid 19. This means that our office will be closed to the public for the foreseeable future and our team will work from home where possible. Viewings must take place on-line where possible. All of our sales properties come with a 3D interactive floorplan and we can provide videos for all of our available rental properties. However, physical viewings can be arranged under certain conditions and we will strictly adhere to them. We would ask all our viewers to adhere to the conditions in the interest of the safety of our team, our clients and other viewers. These conditions are as follows for our sales properties:

Viewings by the public permitted of properties by appointment only where:

· Confirmation provided of (a) proof of funds (b) property previously viewed online.

· Time restricted appointments with sufficient time allowed between appointments to avoid any potential cross over of viewers.

· Viewings by one party of two people from the same household is only permitted.

If you are thinking of selling or letting, we can still carry out inspections of your property (either virtually or in person) in order to give you a detailed opinion of value.

For more detailed information, please visit www.psr.ie.

Our Lettings division will continue to view properties online to potential tenants and can facilitate physical viewings when an agreement is in place between the landlord and tenant.

Our Maintenance division will continue to service all our clients’ maintenance issues as per normal, while adhering to the safety advice from NEPHT.

We are delighted to be able to continue working at this time and want to let all our clients and potential viewers know that we are taking every precaution to ensure everybody’s safety.

Stay safe.